жҢү2019е№ҙзҡ„йҠ·е”®ж”¶зӣҠиЁҲпјҢе…ЁзҗғеҖӢдәәйҳІиӯ·иЈқеӮҷеёӮе ҙйҒ”еҲ°376е„„зҫҺе…ғгҖӮжҢүйҠ·йҮҸиЁҲпјҢе…ЁзҗғдёҖж¬ЎжҖ§жүӢеҘ—еёӮе ҙз”ұ2015е№ҙзҡ„3859е„„йҡ»з©©жӯҘеўһй•·иҮі2019е№ҙзҡ„5290е„„йҡ»пјҢиӨҮеҗҲе№ҙеўһй•·зҺҮзӮә8.2%гҖӮзҫҺеңӢеҸҠжӯҗжҙІзӮәе…ЁзҗғдёҖж¬ЎжҖ§жүӢеҘ—еёӮе ҙж¶ҲиҖ—йҮҸжңҖй«ҳзҡ„е…©еӨ§еҚҖеҹҹпјҢжҢү2019е№ҙзҡ„йҠ·е”®ж”¶зӣҠиЁҲеҗҲиЁҲеёӮе ҙд»ҪйЎҚдҪ”65.7%пјҢиҖҢжҢүйҠ·йҮҸиЁҲеүҮдҪ”59.9%гҖӮ

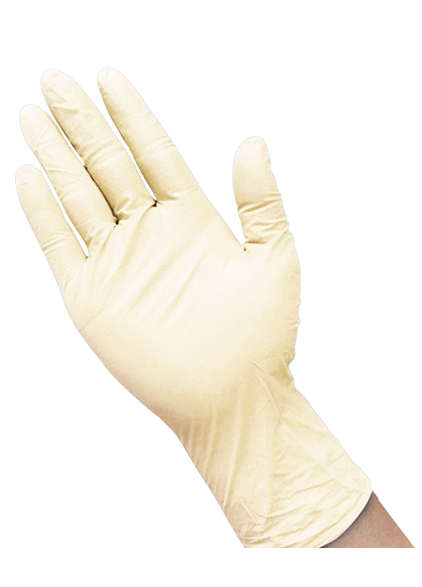

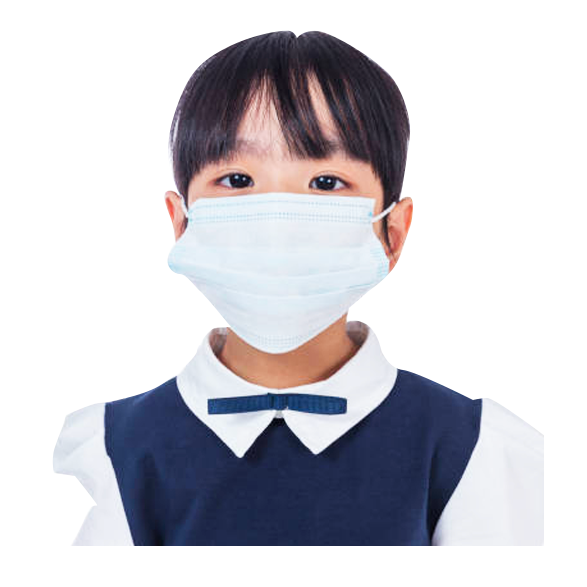

еҖӢдәәйҳІиӯ·иЈқеӮҷжҢҮж—ЁеңЁдҝқиӯ·з©ҝжҲҙиҖ…зҡ„иә«й«”е…ҚеҸ—еӮ·е®іжҲ–ж„ҹжҹ“зҡ„иЈқеӮҷгҖӮе…ЁзҗғеҖӢдәәйҳІиӯ·иЈқеӮҷеёӮе ҙз”ұеӨҡзЁ®з”ўе“Ғзө„жҲҗпјҢж №ж“ҡеҸ—дҝқиӯ·иә«й«”йғЁдҪҚеҲҶзӮәеӨҡеҖӢеӯҗйЎһеҲҘпјҢеҢ…жӢ¬(1)жүӢйғЁйҳІиӯ·з”ўе“ҒпјҢдҫӢеҰӮдёҖж¬ЎжҖ§жүӢеҘ—еҸҠе®үе…ЁжүӢеҘ—пјӣ(2)е‘јеҗёйҒ“йҳІиӯ·з”ўе“ҒпјҢдҫӢеҰӮеҸЈзҪ©пјӣ( 3)иә«й«”йҳІиӯ·з”ўе“ҒпјҢдҫӢеҰӮйҡ”йӣўжңҚпјӣ(4)зңјйғЁеҸҠйқўйғЁйҳІиӯ·з”ўе“ҒпјҢдҫӢеҰӮйқўзҪ©еҸҠзңјзҪ©пјӣеҸҠ(5)е…¶д»–пјҢдҫӢеҰӮе…Қжҙ—ж¶ҲжҜ’ж¶ІгҖӮжҢү2019е№ҙзҡ„йҠ·е”®ж”¶зӣҠиЁҲпјҢе…ЁзҗғеҖӢдәәйҳІиӯ·иЈқеӮҷеёӮе ҙйҒ”еҲ°376е„„зҫҺе…ғгҖӮ2019е№ҙпјҢжүӢйғЁйҳІиӯ·з”ўе“ҒзӮәжңҖеӨ§зҡ„еӯҗйЎһеҲҘпјҢеёӮе ҙд»ҪйЎҚзӮә32.7%пјҢдё”дёҖж¬ЎжҖ§жүӢеҘ—дҪ”и©ІеӯҗйЎһеҲҘ71.3%гҖӮ

з–«жғ…зҲҶзҷјдёҖж¬ЎжҖ§жүӢеҘ—йңҖжұӮеўһеҠ

гҖҖгҖҖдёҖж¬ЎжҖ§жүӢеҘ—дҪңзӮәз©ҝжҲҙиҖ…зҡ„жүӢиҲҮжҡҙйңІйқўд№Ӣй–“зҡ„еұҸйҡңпјҢеҸҜйҳІжӯўз©ҝжҲҙиҖ…дәӨеҸүеӮіж’ӯеҸҠж„ҹжҹ“жұЎжҹ“зү©жҲ–зҙ°иҸҢгҖӮдёҖж¬ЎжҖ§жүӢеҘ—жҢүе…¶жқҗж–ҷеҲҶйЎһпјҢдё»иҰҒеҢ…жӢ¬дёҒи…ҲгҖҒPVCеҸҠд№іиҶ гҖӮдёҖж¬ЎжҖ§дёҒи…ҲжүӢеҘ—з”ұ100%еҗҲжҲҗдёҒи…ҲиҶ д№іиЈҪжҲҗпјҢйҒ©з”Ёж–јйҶ«з”ЁжӘўжҹҘгҖҒйЈҹе“Ғиҷ•зҗҶеҸҠдёҖиҲ¬е·ҘжҘӯз”ЁйҖ”пјҢе…¶дёҚеҗ«иӣӢзҷҪиіӘйҒҺж•ҸеҺҹгҖӮдёҖж¬ЎжҖ§PVCжүӢеҘ—з”ұPVCзіҠжЁ№и„ӮиЈҪжҲҗпјҢйҒ©з”Ёж–јйҶ«з”ЁжӘўжҹҘгҖҒйЈҹе“Ғиҷ•зҗҶгҖҒ家еұ…еҸҠдёҖиҲ¬е·ҘжҘӯз”ЁйҖ”гҖӮдёҖж¬ЎжҖ§д№іиҶ жүӢеҘ—з”ұеӨ©з„¶ж©ЎиҶ д№іиҶ иЈҪжҲҗпјҢйҒ©з”Ёж–јйҶ«з”ЁжӘўжҹҘгҖҒйЈҹе“Ғиҷ•зҗҶгҖҒ家еұ…еҸҠдёҖиҲ¬е·ҘжҘӯз”ЁйҖ”гҖӮдёҖж¬ЎжҖ§д№іиҶ жүӢеҘ—еҗ«еҸҜиғҪжңғиҮҙж•Ҹзҡ„иӣӢзҷҪгҖӮ

жҢү2019е№ҙзҡ„йҠ·йҮҸиЁҲпјҢPVCжүӢеҘ—зҡ„еёӮе ҙд»ҪйЎҚжңҖеӨ§пјҢзӮә37.5%пјҢе…¶ж¬ЎжҳҜдёҒи…ҲжүӢеҘ—еҸҠд№іиҶ жүӢеҘ—пјҢеёӮе ҙд»ҪйЎҚеҲҶеҲҘзӮә32.7%еҸҠ22.7%гҖӮ

жҢүйҠ·е”®ж”¶зӣҠиЁҲпјҢе…ЁзҗғдёҖж¬ЎжҖ§жүӢеҘ—еёӮе ҙз”ұ2015е№ҙзҡ„66е„„зҫҺе…ғз©©жӯҘеўһй•·иҮі2019е№ҙзҡ„87е„„зҫҺе…ғпјҢиӨҮеҗҲе№ҙеўһй•·зҺҮзӮә7.3%гҖӮ

жҢү2019е№ҙзҡ„йҠ·е”®ж”¶зӣҠиЁҲпјҢдёҒи…ҲжүӢеҘ—зҡ„еёӮе ҙд»ҪйЎҚжңҖеӨ§пјҢзӮә45.5%пјҢе…¶ж¬ЎжҳҜPVCжүӢеҘ—еҸҠд№іиҶ жүӢеҘ—пјҢеёӮе ҙд»ҪйЎҚеҲҶеҲҘзӮә27.3%еҸҠ25.0%гҖӮеңЁи©ІдёүеӨ§йЎһеҲҘдёӯпјҢдёҒи…ҲжүӢеҘ—зҡ„йҠ·е”®ж”¶зӣҠеўһе№…жңҖеӨ§пјҢй җжңҹеңЁжңӘдҫҶе°ҮйҖІдёҖжӯҘеўһй•·гҖӮ

зҫҺеңӢе’ҢжӯҗжҙІзӮәдёҖж¬ЎжҖ§жүӢеҘ—жңҖеӨ§еёӮе ҙ

гҖҖгҖҖзҫҺеңӢеҸҠжӯҗжҙІзӮәе…ЁзҗғдёҖж¬ЎжҖ§жүӢеҘ—еёӮе ҙж¶ҲиҖ—йҮҸжңҖй«ҳзҡ„е…©еӨ§еҚҖеҹҹпјҢжҢү2019е№ҙзҡ„йҠ·е”®ж”¶зӣҠиЁҲеҗҲиЁҲеёӮе ҙд»ҪйЎҚдҪ”65.7%пјҢиҖҢжҢүйҠ·йҮҸиЁҲеүҮдҪ”59.9%гҖӮ

жңӘдҫҶпјҢе…ЁзҗғдёҖж¬ЎжҖ§жүӢеҘ—еёӮе ҙзҡ„зҷјеұ•и¶ЁеӢўеҰӮдёӢпјҡ

гҖҖгҖҖжҮүз”Ёж–°е·Ҙи—қеҸҠжҠҖиЎ“гҖӮйҡЁи‘—йҶ«зҷӮиЎҢжҘӯеҸҠйӣ»еӯҗиЎҢжҘӯзҡ„дёҚж–·зҷјеұ•пјҢж–°е·Ҙи—қеҸҠжҠҖиЎ“е°ҮжҮүз”Ёж–јжүӢеҘ—з”ҹз”ўгҖӮеӣ жӯӨпјҢиғҪеӨ еҲ©з”Ёж–°е·Ҙи—қеҸҠжҠҖиЎ“(дҫӢеҰӮиЁӯеӮҷиҮӘеӢ•еҢ–еҸҠдәәе·ҘжҷәиғҪжҠҖиЎ“)зҡ„иЈҪйҖ е•Ҷе°Үжӣҙ具競зҲӯеҠӣгҖӮ

гҖҖгҖҖж•ҲзҺҮжҸҗй«ҳгҖӮйҡЁи‘—жҠҖиЎ“дёҚж–·еҝ«еҚҮзҙҡпјҢиҝ‘е№ҙе»әз«Ӣзҡ„з”ҹз”ўз·ҡеҖҹеҠ©жӣҙе…ҲйҖІзҡ„жҠҖиЎ“иҖҢжңүжӣҙй«ҳзҡ„ж•ҲзҺҮгҖӮйҡЁи‘—з’°дҝқжі•еҫӢжі•иҰҸзҡ„иҰҒжұӮж—ҘзӣҠеҡҙж јеҸҠе·Ҙи—қиҲҮжҠҖиЎ“йҖІжӯҘпјҢй җжңҹжүӢеҘ—з”ҹз”ўз·ҡе°ҮжңғеҚҮзҙҡпјҢжүӢеҘ—з”ҹз”ўж•ҲзҺҮе°ҮзӣёжҮүжҸҗй«ҳгҖӮ

гҖҖгҖҖдҫӣжҮүйҸҲж•ҙеҗҲгҖӮдёҖж¬ЎжҖ§жүӢеҘ—иЈҪйҖ е•ҶеңЁйҷҚдҪҺз”ҹз”ўжҲҗжң¬еҸҠиғҪеӨ жҸҗдҫӣе®ҡеҲ¶з”ўе“Ғзӯүж–№йқўеҸ—зӣҠж–јиҰҸ模經жҝҹгҖӮзӮәеҜҰзҸҫиҰҸ模經жҝҹпјҢиЈҪйҖ е•ҶиҲҮдҫӣжҮүе•Ҷд№Ӣй–“зҡ„й—ңдҝӮж„ҲзҷјйҮҚиҰҒгҖӮеӣ жӯӨпјҢиғҪеӨ ж•ҙеҗҲдҫӣжҮүйҸҲзҡ„дёҖж¬ЎжҖ§жүӢеҘ—иЈҪйҖ е•Ҷе°ҮеҜҰзҸҫиҰҸ模經жҝҹпјҢдёҰеҫһиЎҢжҘӯ競зҲӯдёӯи„«з©ҺиҖҢеҮәгҖӮ

гҖҖгҖҖдёҒи…ҲжүӢеҘ—зҡ„еёӮе ҙд»ҪйЎҚдёҚж–·еўһеҠ гҖӮдёҒи…ҲжүӢеҘ—ж—ҘеҫҢеҫҲеҸҜиғҪжңғзҚІеҫ—жӣҙй«ҳеёӮе ҙд»ҪйЎҚгҖӮйҰ–е…ҲпјҢдёҒи…ҲжүӢеҘ—еҰӮеӨ©з„¶д№іиҶ жүӢеҘ—зҡ„дёҖиҲ¬иҲ’йҒ©гҖҒжҹ”и»ҹгҖҒжңүеҪҲжҖ§пјҢдёҚеҗ«жңғеј•иө·йҒҺж•Ҹзҡ„д№іиҶ иӣӢзҷҪпјҢдё”иіӘйҮҸијғеӨ©з„¶д№іиҶ жүӢеҘ—жӣҙз©©е®ҡгҖӮ第дәҢпјҢйҡЁи‘—з”ҹз”ўжҠҖиЎ“йҖІжӯҘпјҢиЈҪйҖ дёҒи…ҲжүӢеҘ—зҡ„жҲҗжң¬е°ҮйҷҚдҪҺпјҢеӣ жӯӨпјҢдёҒи…ҲжүӢеҘ—зҡ„еғ№ж је°ҮжӣҙзӮәдҪҺе»үгҖӮ第дёүпјҢиҲҮеӨ©з„¶д№іиҶ жүӢеҘ—зҡ„дҫӣжҮүйҮҸеҸ—еӨ©з„¶еҺҹжқҗж–ҷзҡ„йҷҗеҲ¶зӣёеҸҚпјҢдёҒи…ҲжүӢеҘ—еҸҜеӨ§иҰҸжЁЎз”ҹз”ўпјҢд»Ҙж»ҝи¶іCOVID-19еҲәжҝҖз”ўз”ҹзҡ„дёҚж–·еўһй•·зҡ„йңҖжұӮгҖӮ

з•ҷдёӢи©•и«–